buying your HOME

BUYING A HOME

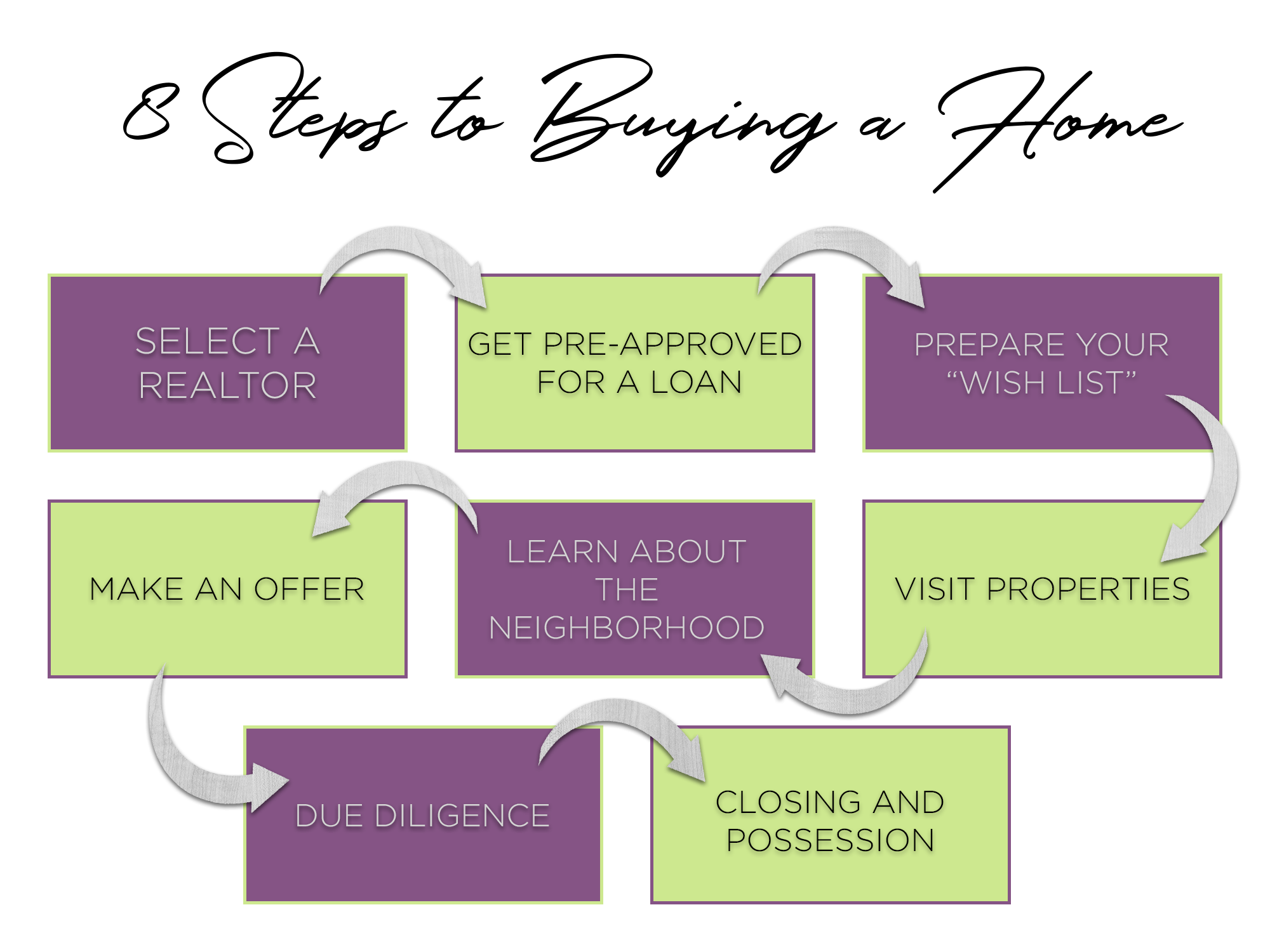

To assist in this process, we’ve come up with a comprehensive 8 step process that will help you buy your new home.

Select a Realtor®

A Real Estate agent can be called a Realtor® only after joining the Association and subscribing to a strict “Code of Ethics” (which goes well beyond state law). It is through the Realtor Association that the Agent agrees to collectively share the information on all houses listed for sale. This is done through the MLS or Multiple Listing Service.

Get Pre-Approved for a Loan

This is a vital step in the buying process – often, the difference between having your offer accepted or rejected. It is our policy for each Buyer to obtain a “Pre-Approval” letter from a reputable Mortgage Lender which will be included with any purchase offer you wish to submit on a home. We will assist you in this process.

Whether you’re a first-time buyer looking for the perfect starter house, or a seasoned pro trading up to your Custom Mountain dream home, you are probably asking the same questions: Can I afford this? And is this the right move at the right time?

As a first step, we will ask you a series of questions such as: your available cash reserves, income, current debt, cash to be freed up on the sale of your existing home, employer provided allowances for moving costs, and so on.

In this way, we can provide you with a good estimate of your purchasing power and recommend you to a mortgage lender most suited to help you whether you require: FHA, VA, Jumbo, Conventional, or a first time home buyer program. We will do this for you whether you are Credit Perfect or Credit Challenged!

Prepare Your “Wish List”

Tell us your wants and needs for the home which ideally you would like to find.

We want you to tell us what you consider important!

Consider many factors including:

- price of home;

- size of home;

- number of bedrooms and bathrooms;

- garage size;

- lot size;

- commuting time to work place;

- access to recreational activities;

- age of home;

- time until you plan to move in;

- neighborhood conditions;

- style of home: contemporary, traditional, ranch, 2-story;

- length of time you expect to live in this new home;

- new home versus previously owned home, etc.

This is an excellent opportunity to get input from all your family.

We will use this as my starting point to help you locate the house which most closely meets your requirements. We will also use this as a basis to make you aware of some features, which may be unique to the Area’s homes and neighborhoods, which you may find desirable.

It’s important for us to know what you are looking for.

Visit Properties

Included in this report will be maps specific to the area where the homes are located.

After getting feedback from you on which homes appeal to you, we will schedule appointments to personally visit the selected homes.

Please keep in mind that in today’s market good homes, well priced in a good location, seldom last more than 2-3 weeks on the market. We will get daily reports on homes matching your criteria as they become available. You will be notified immediately as particular homes meeting your needs come to our attention.

Learn About the Neighborhood

- Neighborhood demographics

- Public and private schools

- Average home values, past sales

- Schools

Make an Offer

Once you decide which house you wish to place an offer on, you will have many decisions to make including:

- Purchase price you wish to offer

- Financing terms, cash down payment, earnest money deposit, type of loan, interest rate, pre-approval letter

- Time period for inspection of property

- Time period for appraisal of property by your lender

- Time period to review title opinion of property

- Contingencies you wish to include

- Time period for loan approval

- Setting the date and time of closing

- Presenting the offer to Sellers

- Negotiating and finalizing any terms and conditions which the Sellers may wish to modify from the original offer presented to them through a counter-offer

Through this entire process of preparing, offering and negotiating the Purchase Offer, we will work closely with you to maintain timely responses and provide market savvy answers to questions as they come up.

Due Diligence

Specifically, you will want to have an inspection of the property for such things as: the mechanical, plumbing, and electrical systems, the foundation, walls, flooring and windows. You will want to see a preliminary report of title on the property to determine any easements or issues of title. Your mortgage lender will require an independent appraisal of the property.

Any problems noted during the inspection are subject to additional negotiations between you and the Sellers. We will help facilitate this process. If you are not comfortable with the inspection resolution with the Seller, you will have the right to terminate the contract, if acted upon in a timely manner.

Closing and Possession

Time of possession is established at the time of negotiating the original offer. In Colorado, it is customary for the Buyer to take possession at closing or up to 2 days after closing.

How’s the Market?

Know what the market is doing. Visit our exclusive Neighborhoods page to learn about the top South Metro areas to live in. Visit Our Market Info page to learn what’s really happening in the market with our actionable and up to date market metrics.

Neighborhoods

data driven Info

Want our Top Tips to buy or sell your home?

We are Giving Away our exclusive Free guide:

“Buying or Selling your Home – Where to Start”

Contracts and Disclosures | Getting Pre-approved | Showing your Home | Multiple Offers